What You Need to Know and How to Comply

The following information applies to Washington State businesses in the Construction Industry. There are new WA State Paid Sick Leave (PSL) laws that go into effect on 1/1/2024. If these changes apply to you, we are ready to assist you in updating your PSL Policy and Employee Handbook. Just reach out to your assigned HR Consultant if you have one or call 800.317.1378 or email us at hrhelp@jbconsultingsystems.com.

Here is a summary & decision tree that you can use to determine if these changes apply to you and if they do, what the changes are:

Do you work in construction or exclusively residential construction?

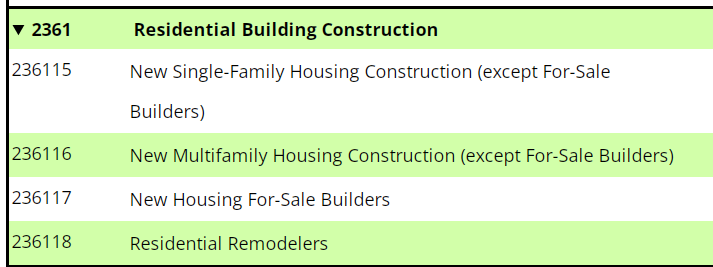

- To make this determination, what NAICS code did the WA Department of Revenue assign to your business?

- If your company was assigned or your employees work under NAICS 2361, exclusively residential building construction, your company/non-exempt employees are exempt from these changes in the law.

- If you were assigned any of the other NAICS codes under 23 Construction, these changes do apply to you please contact your HR Consultant about making changes to your PSL/PTO policy and/or Employee Handbook.

- If you have employees that work both residential and commercial, the new laws apply to you. Again, if this is your situation, contact us to update your appropriate policy/handbook.

- Use the link above to see the other NAICS codes that are subject to implementing these new laws as of 1/1/2024. They include non-residential building construction (2362); Utility System Construction (2371); Land Subdivision (2372); Highway, Street, and Bridge Construction (2373); Other Heavy and Civil Engineering Construction (2379); Foundation, Structure, and Building Exterior Contractors (2381); Building Equipment Contractors (2382); Building Finishing Contractors (2383); and/or Other Specialty Trade Contractors (2389).

What are the changes and how do I comply with the changes?

- If an hourly employee separates from your Company before reaching 90-calendar days of employment, you are required to pay out their unused Paid Sick Leave (PSL) accrual on their last payroll check.

- If you have a PTO policy that includes accrual of time under the PSL laws (versus having a separate PSL policy and a PTO policy), you are required to pay out at a minimum, any accrued time that is equal to what they would have earned using the PSL calculation (1 hour for every 40 hours), at their time of separation, if it is prior to the employee reaching their 90-calendar days of employment.

- You should include all non-exempt employees in this change even if they are not “construction workers.” For instance, non-exempt administrative would be eligible for this same accrued PSL payout if they separate before reaching their 90-calendar day of employment.

- The reason for separation does not matter – it can be voluntary or involuntary – if it occurs prior to that 90-calendar day of employment, you are required to pay that time out to the employee on their last payroll check.

- You must also maintain records that include:

- The amount of PSL (or PTO) that you pay out to the employee following their last day worked;

- The date(s) of separation from employment (this is typically the last day worked or the effective date of the separation); and

- Any start date(s) for that employee.

- The PSL (or PTO) must be paid out at the employee’s normal hourly compensation, which is the rate they would have received should they have worked. This is typically their hourly rate unless you have employees that have multiple rates of pay, depending on the type of work being performed. For instance, if the person is 50% residential and 50% commercial and you pay them a higher rate when they are working on a commercial job, the payout of that PSL should be reflective of that dual rate and you should document how you determined the percentages.

- If the employee is rehired with your company within 12-months from their date of separation, you:

- Are not required to reinstate any PSL that was paid out to the employee that separated prior to meeting their 90-calendar day of employment; and

- Must count the previous period of employment for the purposes of determining the date in which the employee will be entitled to use future PSL accruals (meaning towards the counting towards that 90-calendar days of employment).

- Also, if the employee reaches their newly revised 90-calendar day of employment (because you gave them credit for their previous employment time), and they use up their accrued PSL but still need to be out unpaid for reasons that fall under the PSL (safe and sick reasons), you are required to “protect” those unpaid absences up to the amount of time you paid out to the employee previously as accrued PTO. This means you can’t adversely impact, which includes terminate or discipline the employee, for using that time off for eligible reasons, even though they are not getting paid.

EXAMPLE:

- Employee is hired 1/15/2024;

- They work 45 hours per week;

- They resign and their last day worked was 2/9/2024.

- They have worked 4 weeks at 45 hours per week, for a total of 180 hours worked. At the rate of 1 hour for every 40 hours, the employee has accrued 4.5 hours of PSL, that will be paid out to the employee in their final payroll check. Additionally, it should be noted that they worked 40-calendar days.

- The same employee is rehired with a start date of 4/1/2024.

- Since you paid out their PSL when they left, you don’t reinstate their accrual amount, but on their rehire date, that becomes their 41-calendar day of employment towards the use of accrued PSL time. 5/20/2024 becomes their new 90-calendar day of employment and they are eligible to begin using PSL that they have accrued since returning as of that day.

- On 5/28/2024, the employee gets COVID and needs to isolate for 10 calendar days, which means they will miss 8 days of work (or 64 hours). They use their 8 hours of PSL, which is paid and are eligible for unpaid protected time in the amount of 4.5 hours, which is the PLS time that was paid out during their first period of employment. The additional 51.5 hours of unpaid time off that the employee needs to take for isolation is unprotected unless another leave law would apply and provide pay (maybe WA Paid Family Medical Leave), or protected time off (maybe WA State Disability Laws).

There are some optional practices and nuances written into the law related to collective bargaining agreements or if you front-load PSL time for employees. However, if they do and/or if you are assigned a NAICS code that is not specific to residential construction, contact an HR Consultant here at JB Consulting Systems to discuss incorporating these changes into your policy/Employee Handbook or call us at 800.317.1378.

Sources:

- https://www.lni.wa.gov/workers-rights/leave/paid-sick-leave/paid-sick-leave-minimum-requirements

- https://www.perkinscoie.com/en/news-insights/new-paid-sick-leave-and-minimum-wage-laws-in-washington-state-effective-january-1.html

- https://www.barran.com/ealerts/upcoming-changes-to-washington-paid-sick-leave-and-minimum-wage